Contracts for Difference (CFDs) have emerged as a popular investment vehicle for traders seeking exposure to diverse financial markets. Let’s explore the ins and outs of CFD trading and what sets it apart from traditional forms of investing.

Understanding CFDs

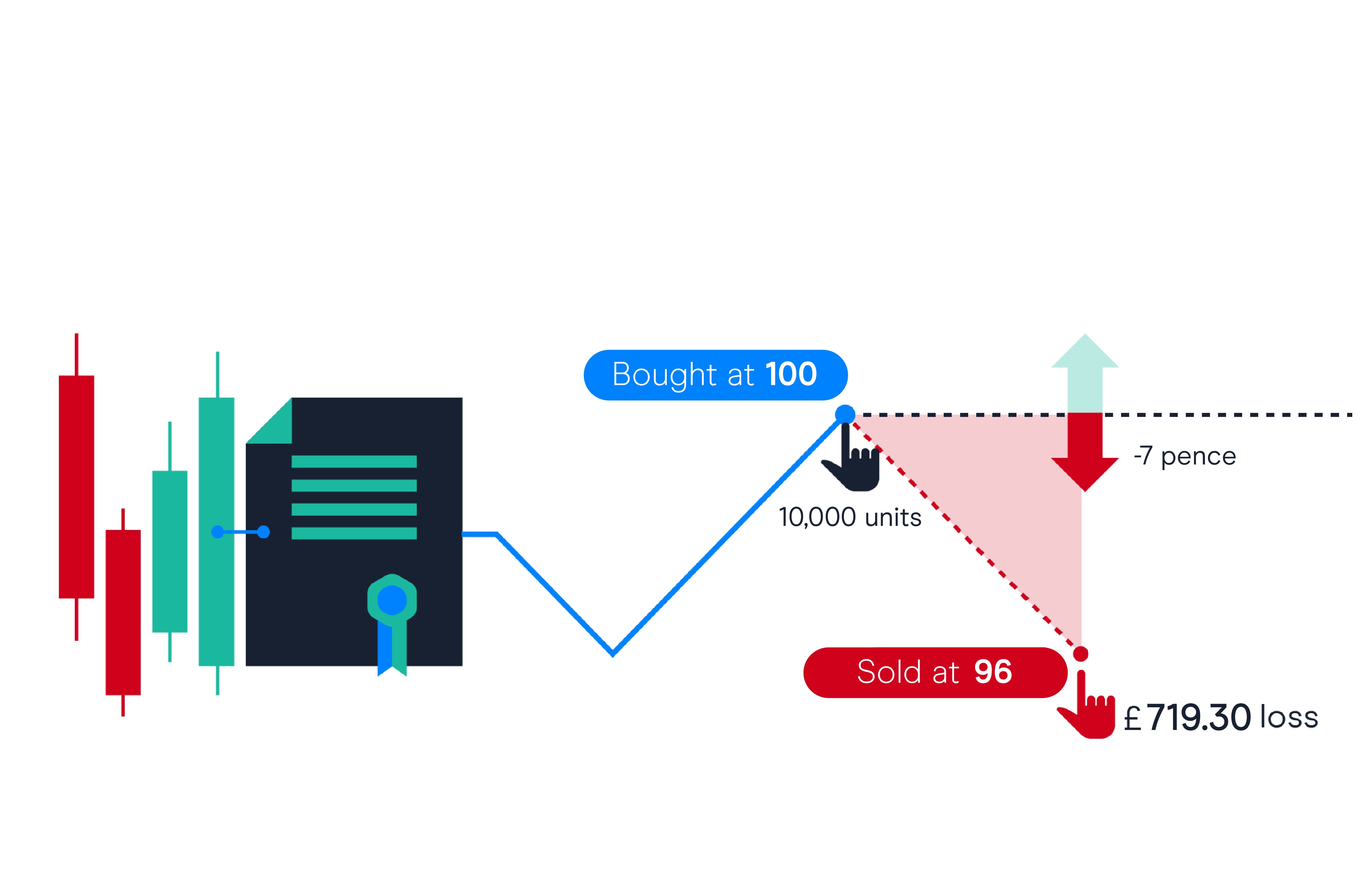

CFDs are financial derivatives that enable traders to speculate on the price movements of underlying assets, such as stocks, indices, commodities, and currencies, without owning the assets themselves. Instead, traders enter into a contract with a broker to exchange the difference in the asset’s price between the opening and closing of the contract.

Advantages of CFD Trading

One of the primary advantages of CFD trading is the ability to profit from both rising and falling markets. Unlike traditional investing, where investors can only profit when the price of an asset increases, CFDs allow traders to take short positions and profit from price declines.

Additionally, CFDs offer flexibility in terms of leverage, allowing traders to amplify their exposure to the market with a relatively small initial investment. This can potentially lead to higher returns, but it’s essential to use leverage cautiously as it also increases the risk of losses.

Key Considerations

While CFD trading offers numerous benefits, it’s essential for traders to understand the risks involved. Market volatility, overnight financing charges, and the potential for significant losses are factors that need to be carefully managed.

Moreover, traders should conduct thorough research and analysis before entering into CFD positions. Having a well-defined trading strategy, implementing risk management techniques, and staying informed about market developments are crucial for success in CFD trading.

Conclusion

In conclusion, CFDs provide traders with a versatile instrument to access global financial markets and capitalize on price movements. With their unique features and potential benefits, CFDs have become an integral part of many traders’ investment portfolios. However, it’s important to approach CFD trading with caution and ensure proper risk management to navigate the inherent challenges effectively.